South Carolina Contractor License Bonds

Instant Approvals | Competitive Rates | Trusted Service Since 2003

Get Your South Carolina Contractor License Bond Online Today!

Contractors in South Carolina—including general contractors, residential builders, specialty trades, and mechanical contractors—must secure a contractor license bond as part of the licensing process. A contractor license bond protects clients and ensures compliance with state regulations, while also boosting your professional credibility.

- Instant approval online

- Competitive premium rates (often 1–5% of bond amount)

- PDF certificate delivered immediately

- Backed by a trusted surety carrier (not just an agent)

What is a South Carolina Contractor License Bond?

A contractor license bond is a type of surety bond required by theh (LLR). Its purpose is to guarantee that the contractor will abide by state laws, licensing regulations, and contractual commitments. If the contractor violates rules or leaves a job incomplete, the bond provides financial recourse for affected parties.

Why Do You Need a Contractor License Bond?

- Legal Requirement: It’s mandatory for licensing in South Carolina.

- Consumer Protection: Safeguards clients against incomplete or substandard work.

- Professional Credibility: Demonstrates your commitment to industry standards.

Types of South Carolina Contractor License Bonds

Residential Builder Bond

Residential specialty contractors must either have a license bond or register with the Residential Builders Commission (RBC), depending on the type of work they’ll be performing. This is per the state’s Contractor Code of Laws. The government created rules for fair business practices to protect finances, requiring a $5,000 surety bond. This $5,000 surety bond helps to protect consumers and ensure that contractors comply with state regulations.

Residential Specialty Contractor Bond

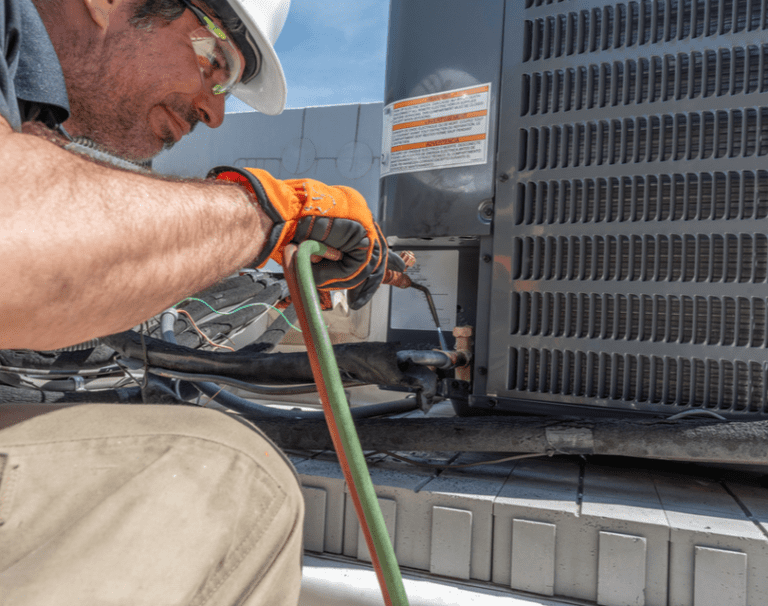

Licensed specialty contractors such as HVAC contractors, plumbers, and electricians, need a $10,000 bond. A contractor’s bond is essential for protecting consumers and ensuring contractors meet their legal liability.

General Contractor License Bonds

Required for contractors working on projects valued at $10,000 or more.

Instead of providing a financial statement showing a minimum net worth for a licensed group as required by Section 40-11-260, a South Carolina General Contractor applicant may provide a surety bond of two times the required net worth for the applicant’s license group with his initial or renewal application.

General contractor bonds are required for overseeing construction sites and ensuring compliance with vendor coordination and regulations.

Mechanical Contractor License Bonds

Required for mechanical contractors, such as HVAC, plumbing, and electrical services.

Effective May 2018, the Contractor Licensing Board will accept a Mechanical Contractor surety bond in place of qualification by the previous minimum net worth standards. Starting from the 2018-2019 license renewal, the Board can now accept a surety bond instead of a financial statement.

This applies to both renewals and new applications. An applicant can give a surety bond worth twice the net worth requirement for the Group Level they are applying for.

How Much Does a Contractor License Bond Cost?

The cost of your bond (the premium) is a percentage of the total bond amount, typically ranging from 1% to 5%, based on your credit score and financial history.

- Example: For a $20,000 bond, premiums range from $200 to $1,000 annually.

How to Get Your Contractor License Bond

Apply Online or CALL NOW

- Fill out our simple online application with your basic information.

Instant Approval

- Most applicants receive immediate approval thanks to our streamlined process.

Download Your Bond

- Access your bond certificate instantly upon payment and approval.

Submit to LLR

- Provide the bond certificate to the South Carolina LLR with your license application.

Why Choose Palmetto Surety Corporation?

- Over 20 years of experience issuing contractor bonds

- Direct relationship with insurance carriers — no middle agents

- Fast underwriting and issuing — get your bond in minutes

- Flexible bonding solutions even for those with less-than-perfect credit

- Responsive support & service throughout the process

Get Your South Carolina Contractor License Bond Fast & Easy

Frequently Asked Questions

- A financial guarantee ensuring contractors comply with state laws and contractual obligations, protecting consumers from financial loss.

Who Needs to Obtain This Bond?

- Any contractor in South Carolina engaging in projects that require licensing under state regulations.

How is the Bond Amount Determined?

- The bond amount is set by the South Carolina LLR based on your contractor classification and the scope of work.

Can I Get a Bond with Bad Credit?

- Yes! We offer bonding solutions for all credit types. Premiums may vary based on credit history.

How Long is the Bond Valid?

- Contractor License Bonds are typically valid for one year and need to be renewed annually.

Ready to Secure Your Contractor License Bond?

Ready to secure your South Carolina contractor license bond? CALL NOW

South Carolina Contractor License Bond as an easy select, pay, and download so you can have your bond in about 5 minutes!