South Carolina

Contractor License Bond

Contractors License Bond Information 2024 Update

Bond for South Carolina contractors or residential builders issued by the South Carolina Department of Labor, Licensing and Regulation.

$5,000 Residential Builder Bond

In South Carolina, residential specialty contractors must either have a license bond or register with RBC. This is per the state’s Contractor Code of Laws. The government created rules for fair business practices to protect finances, requiring a $5,000 surety bond. This $5,000 surety bond helps to protect consumers and ensure that contractors comply with state regulations.

$10,000 Residential Contractor Bond

Licensed specialty contractors in South Carolina, such as HVAC contractors, plumbers, and electricians, need a $10,000 bond. A contractor’s bond is essential for protecting consumers and ensuring contractors meet their obligations.

General Contractor License Bonds

Oversight of a construction site, management, and coordination with vendors.

Instead of providing a financial statement showing a minimum net worth for a licensed group as required by Section 40-11-260, a South Carolina General Contractor applicant may provide a surety bond of two times the required net worth for the applicant’s license group with his initial or renewal application.

Obtaining a general contractor’s license in South Carolina may require a surety bond to ensure compliance with licensing rules and regulations, which is a crucial part of maintaining a contractor’s license.

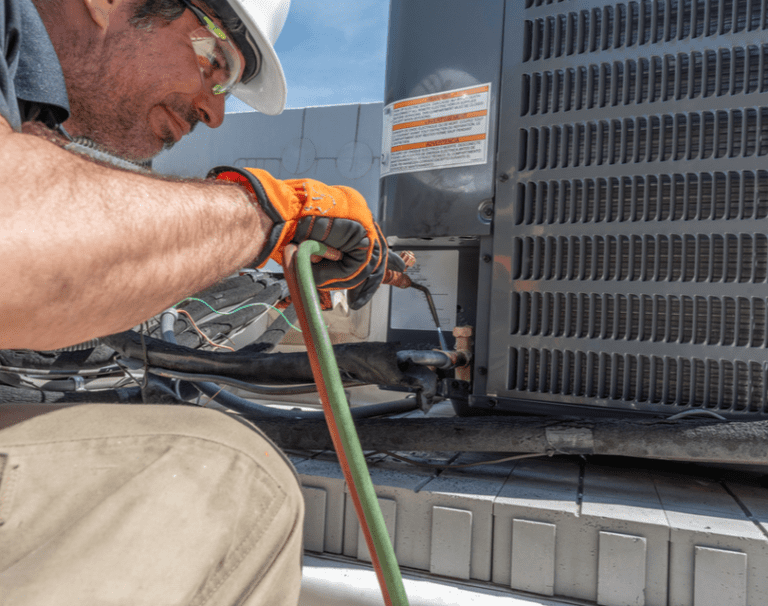

Mechanical Contractor License Bonds

HVAC, Refrigeration, Plumbers and Electrician Bonds

Effective May 2018, the Contractor Licensing Board will accept a South Carolina Mechanical Contractor surety bond in place of qualification by the previous minimum net worth standards. Starting from the 2018-2019 license renewal, the Board can now accept a surety bond instead of a financial statement.

This applies to both renewals and new applications. An applicant can give a surety bond worth twice the net worth requirement for the Group Level they are applying for.

A contractor bond protects parties such as customers, suppliers, and employees in the event that a contractor does not comply with state law. It is crucial to find a reliable surety company to obtain the necessary bond, as they will guide you through the underwriting process and consider factors such as personal credit score, number of years in business, and bond limit.

What is a South Carolina Contractors License Bond?

A South Carolina Contractor’s License Bond is a type of surety bond required by the South Carolina Department of Labor, Licensing and Regulation (LLR) for individuals or businesses seeking to obtain or renew a contractor’s license in the state of South Carolina.

Similar to the Contractors State License Board (CSLB) in California, which mandates contractor license bonds, the South Carolina LLR ensures that contractors carry a bond to protect consumers and the state. This bond is a financial guarantee. I

t protects consumers and the state. It is in place if the licensed contractor fails to fulfill their obligations. These obligations include finishing a construction project and following state rules. The contractor bond protects consumers and ensures that contractors comply with state regulations.

Here’s how it typically works:

Requirement: When getting a contractor’s license in South Carolina, you might need a surety bond as part of the process. The specific bond amount required can vary depending on the type of license and the scope of work.

Surety Bond Provider: To get a South Carolina Contractor’s License Bond, you must work with a surety bond provider or insurance company. The surety company issues the bond. As the contractor, you must pay a premium for the bond. The premium is typically a percentage of the bond amount and depends on factors such as your credit history and the type of bond.

Bond Coverage: The bond protects consumers and the state if the contractor fails to meet their obligations. If the contractor fails to finish the project as agreed or follows state rules, you can claim the bond.

Claims Process: The surety company will investigate a filed claim to check its validity. If the claim is valid, the surety will provide financial compensation to the harmed party. However, we will limit the amount given to the specific amount stated in the bond.

Contractor: The Contractor must repay the surety company for any claim paid out on the bond. This means the bond is not insurance but rather a financial guarantee that ensures the contractor’s financial responsibility.

Consumers and the state require a South Carolina Contractor’s License Bond to protect against financial losses. This bond is crucial as it protects against damages caused by licensed contractors or their failure to finish a job.

It helps ensure that contractors operate ethically and professionally within the bounds of the law and their contractual agreements. Contractors must know the bonding rules from South Carolina LLR and work with a trustworthy bond provider to meet them.

SuretyBonds.co issues the South Carolina Contractor License Bond as an easy select, pay, and download so you can have your bond in about 5 minutes!